The Federal Government has taken a major decision: from 1 January 2026, the use of the Peppol electronic invoicing network will become compulsory for B2B (Business to Business) transactions, in a similar way to what has been required since 2023 for the majority of B2G (Business to Government) transactions.

What exactly is the PEPPOL network? Why is it good news for businesses, and how can they prepare effectively for this major change? Cédric Nève, CEO of Digiteal and e-invoicing expert, member of the FEB commission and the Agoria expert group, sheds light on these questions.

What is the Peppol network?

PEPPOL stands for Pan-European Public Procurement On-Line. This network, set up by the European Commission, aims to standardise and accelerate the adoption of electronic invoicing among Member States, firstly for public procurement, then for business-to-business transactions and potentially, in time, for B2C (Business to Client) invoicing.

PEPPOL is used well beyond the borders of the European Union. As an international network, PEPPOL is accessible in no fewer than 37 different countries, including European countries such as Belgium, France, Germany, the Netherlands, the United Kingdom, Poland, Portugal, Greece, Norway, Finland and Iceland, as well as outside Europe, in Canada, Japan, Australia, Mexico and Singapore.

How does the Peppol network work?

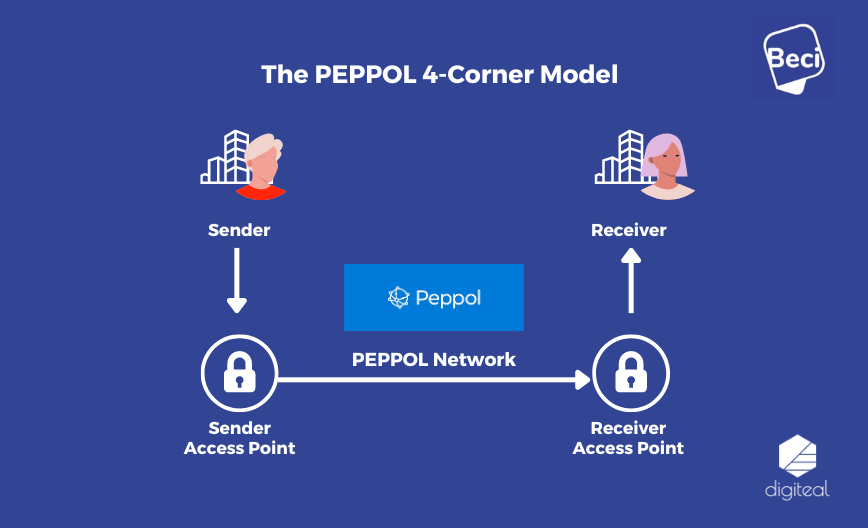

Peppol operates on the so-called ‘4-corner’ model, consisting of:

1) The sender

2) The sender access point

3) The receiver access point

4) The receiver

The sender sends the invoice via a Peppol access point (in most cases, via its invoicing software). His access point then checks whether the receiver is registered in the Peppol directory. If so, the invoice is sent and received by the customer for processing.

B2B electronic invoicing: your obligations from 2026

The Royal Decree of 9 March 2022 has made the use of electronic invoicing compulsory in most public procurement and concession contracts. The invoices concerned must therefore be issued and sent via the Peppol platform.

From 1 January 2026, all Belgian B2B companies will also be required to use structured electronic invoices for all their transactions (sales invoices & purchase invoices).

The federal government has opted for the European Peppol network to guarantee the standardisation of these procedures. An extensive awareness campaign, run by the Federal Public Service Finance, will inform all stakeholders throughout this fast-approaching transition period. Companies are therefore strongly advised to prepare for this new era of invoicing without delay.

What are the advantages of electronic invoicing via Peppol?

Using the Peppol electronic invoicing network goes far beyond a simple regulatory obligation. It offers businesses a host of significant benefits:

● Reduced operational costs: adopting Peppol significantly reduces the expenses associated with traditional methods (stamps, postage, etc.), as well as the manual encoding and processing of paper or emailed invoices.

● Fewer manual errors: the network automates a large part of the invoicing process, which consequently reduces errors due to manual input and the time spent correcting them.

● Faster payment collection: companies benefit from faster payment thanks to more efficient invoice management by their customers, optimising cash flow.

● International reach: available in 37 countries, the Peppol network continues to expand, facilitating business transactions on a global scale.

● Enhanced security: documents exchanged via Peppol are protected by advanced encryption protocols. In addition, the identity of the sender and receiver is systematically verified using a unique identifier (Peppol ID).

How to prepare for Peppol electronic invoicing

Chances are you are already using electronic invoicing software. To comply with current standards, your invoicing/accounting software must be compatible with the Peppol network via a certified Peppol access point.

BOSA, the federal administration responsible for electronic invoicing, offers a (non-exhaustive) list of solutions that have this connectivity.

If your e-invoicing software does not yet offer a connection to Peppol, we recommend that you select your access point by considering (at least) the following five criteria:

1) Quality and ease of use of the Peppol access point API: APIs (Application Programming Interfaces) that are easy to integrate are to be preferred, so as to reduce the time needed to connect to Peppol.

2) Ability to return information in real time: it's important that the solution's interface provides immediate feedback so that you can manage your operations as efficiently as possible.

3) Authorised document size: make sure that the access point can handle large files (e.g. 25 MB), especially if your transactions include large attachments, to avoid any limitations that could hamper your operations.

4) Conformity with validator updates [1]: the access point must use the latest technologies and respect the current versions of the Peppol validator to ensure that your documents are accepted without error by recipients.

5) Adherence to open standards: give preference to access points that favour open standards. The use of proprietary networks should remain the exception in order to keep pricing low, commensurate with the value provided.

Conclusion

The way you exchange, receive and process invoices is likely to change in the near future. However, although this change will become legally binding, it offers many reasons for businesses to rejoice!

Thanks to Peppol, you'll not only be able to save money and time, but also improve your operational efficiency. What's more, you'll benefit from faster processing and payment of your invoices.

We strongly recommend that you check whether your invoicing software is ready to connect efficiently to the Peppol network, at the lowest possible cost. If your current system is not yet ready, contact your supplier now so that they can prepare your transition to electronic invoicing via Peppol and enable you to benefit from its many advantages straight away.

And if you want an even more pragmatic explanation, join us for our training session on this subject on 2 July 2024. Anne GEORGES will help you become an e-invoicing expert.