Setting a business in Brussels

Why come to Belgium?

- Belgium is strategically located at the heart of Europe's largest megalopolis, the European backbone that crosses the continent from London to Milan.

- Its position at the heart of Europe makes it easy to reach almost 500 million consumers.

- Brussels is just a few hours from Europe's biggest stock exchanges: London - The City, Paris - La Défense, Amsterdam - Berlage stock exchange, and Frankfurt - La Börse Frankfurt.

- Belgium is in the immediate vicinity of numerous transport links (motorways, railways, and commercial ports)

- It has a high-quality skilled workforce

- The population is often multilingual (at the heart of many European institutions)

- Belgium's banking system is particularly reliable, making it possible to arrange risk-free loans.

- Financial advantages for opening a business in Belgium:

° Simple and reduced administrative procedures,

° Lower tax rate than in other countries, such as France or Germany.

° Tax treaties signed with the major Asian financial centres (Hong Kong, Macao, etc.): this makes it easier to market your products internationally.

… and Brussels?

- Brussels, the capital of Belgium and the European Union, a home for major European and International institutions, gives you the benefit of a truly international environment.

- Brussels-Capital is the only bilingual administrative region in Belgium where you can choose between French and Dutch for all your official documents.

- Brussels accounts for 21% of Belgium's GDP.

- When you set up your business in Brussels, you become part of the Brussels ecosystem, with its 42,000 legal entities within a radius of just 3 km.

- You can become a member of the Brussels business community via Beci - Brussels Chamber of Commerce and Industry and benefit from networking, events, training, access to international platforms, expert support, and much more!

Ready to embark on a great adventure of launching your business in Brussels?

The partnership of Beci - Brussels Chamber of Commerce, Partena Professional, and KBC Brussels will support you along the way!

Things to consider, before you start

- First, you need to choose your status, your legal form, and finally the type of company, if applicable. In this document we will guide you to make this decision.

- In which region of Belgium do you want to register your business? Belgium has three distinctive regions: Flanders, Wallonia, and Brussels-Capital Region. Requirements, processes, and support are slightly different in each region, but the most important difference is the language. All official documentation in Flanders comes in Dutch, in Wallonia – in French, and in Brussels it can be in any of the two. German is also one of the official languages in Belgium, with a small German-speaking community in Wallonia, but German is not used in Brussels.

- If you reside in in Wallonia and want to start as a self-employed or create a company with the head office Wallonia, you must prove your entrepreneurial abilities, namely basic management knowledge and professional skills, if applicable. In Brussels-Capital Region and in Flanders° it is not needed. We advise you to contact one of the business counters in Wallonia.°

- All the procedures in this document refer to setting your business in the Brussels-Capital Region.

° If you are interested in setting up your business in Flanders, please check this regional government's website and their hub for business setting VLAIO

° For Wallonia, address the region's official website and their hub for business setting 1890.

- You should of legal age (at least 18 years old)

- You need to be an EU citizen. Non-EU citizens need to have a professional card for non-European nationals (both to be self-employed and open a business)

- You have never been convicted of serious misconduct or crimes

- You have legal capacity (you are not led by a provisional administrator and you haven’t been declared legally or judicially incompetent)

- In Wallonia you need to demonstrate that you have required professional skills with a degree, specific professional knowledge or a basic knowledge of business management. Only diplomas or certificates granted by officially recognised educational institutions are accepted. Diplomas and certificates from private schools or institutions aren’t.

If you don’t have a certificate, but your spouse/partner does – it is also an option.

Another option for some occupations is to take a practical test.

Read more about professional skills requirements here: Partena Professional: Become self-employed

Which legal form should I choose?

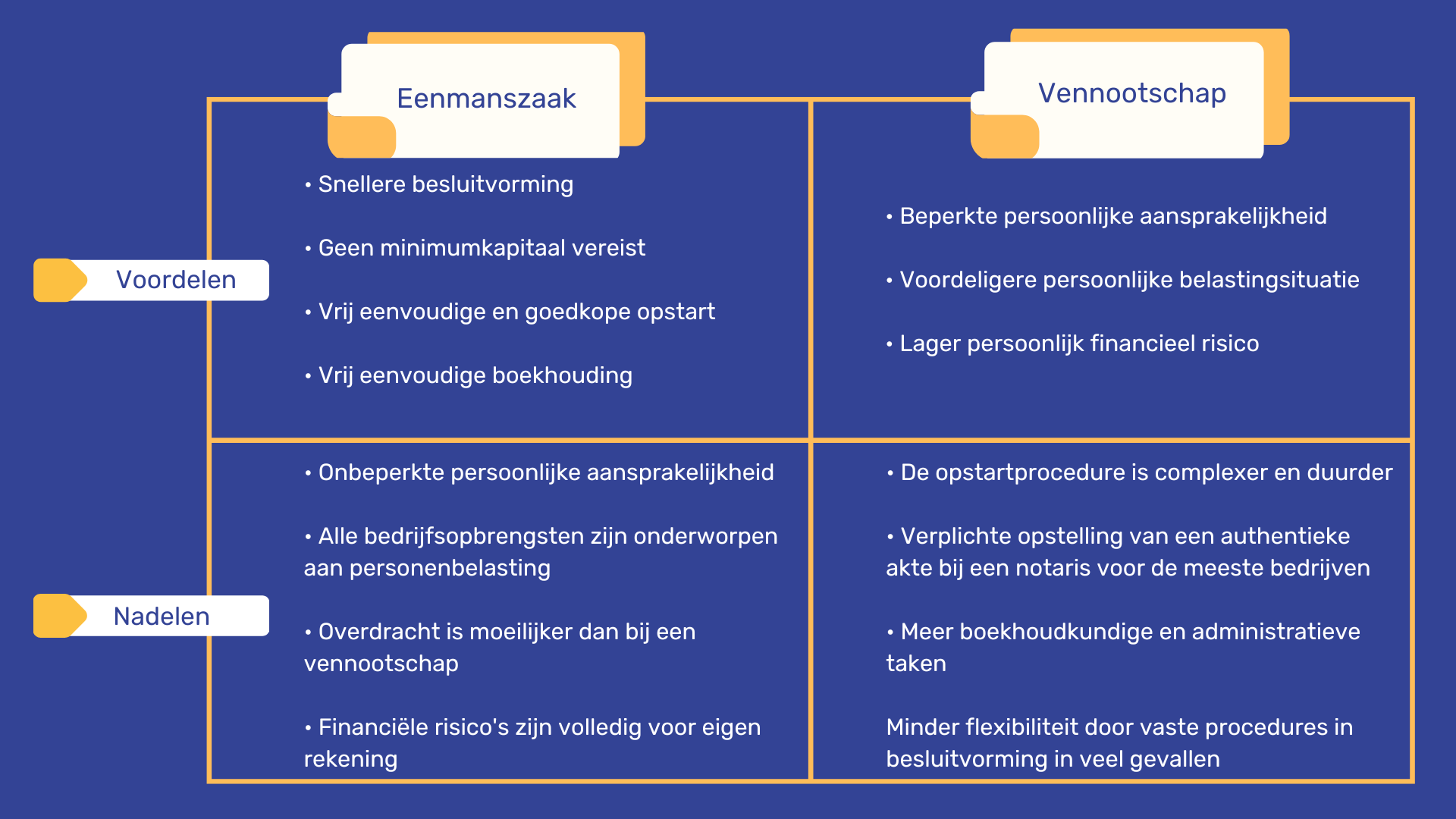

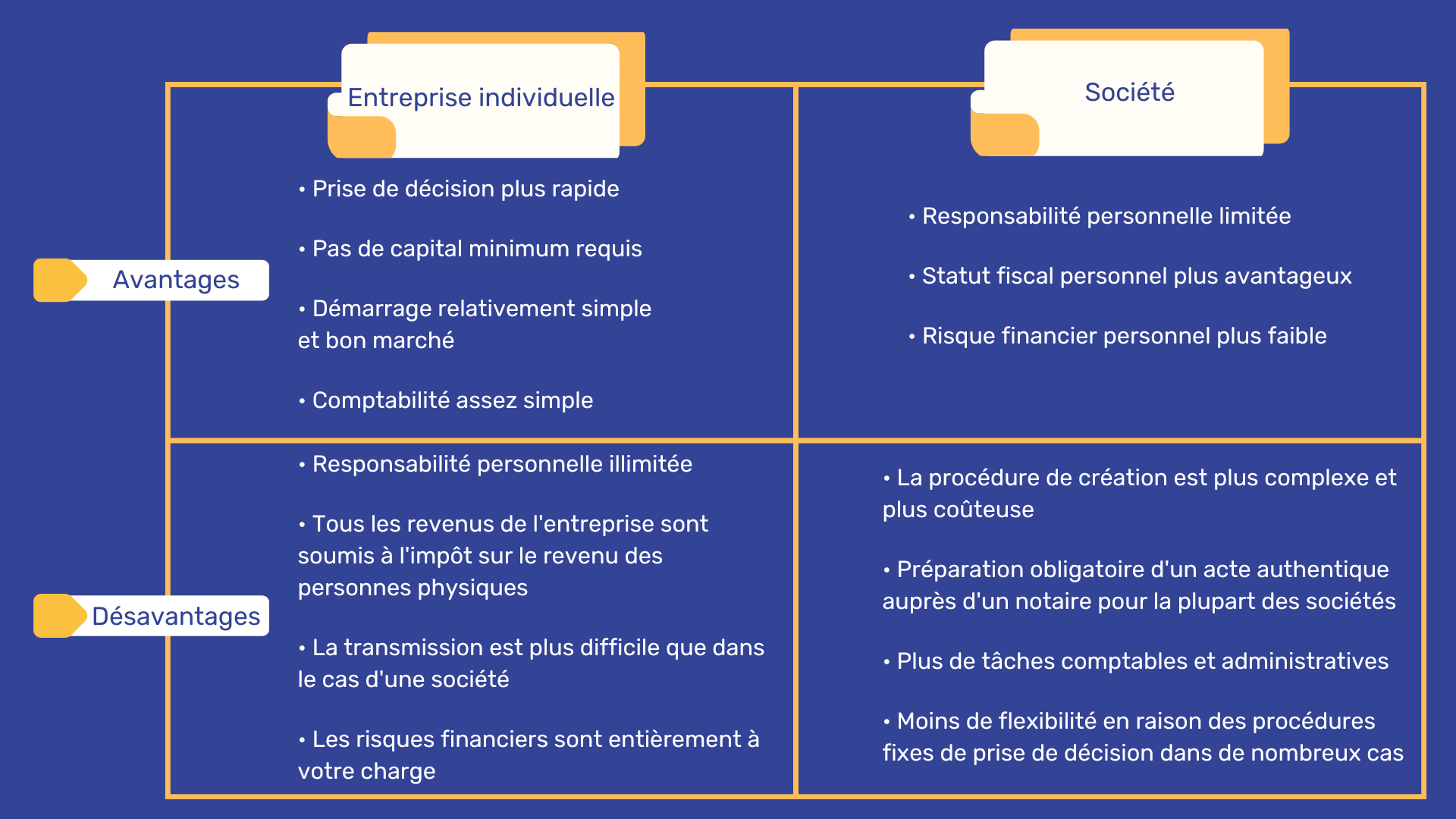

You have two options:

- to become self-employed (so-called “physical person” - FR: personne physique ; NL: naturlijke persoon) or

- to create a legal entity (FR: personne morale ; NL: rechtspersoon).

Each form has its own specifics; it's up to you to choose the form best suited to your situation.

You can choose to set up a sole proprietorship (i.e. have a one-person business) as an individual. In this case:

· there is no difference between you as a person and your company;

· there are fewer formalities and start-up costs;

· you are personally liable.

Your business can also take the form of a legal entity or company. This form provides:

· better personal protection

· more advantageous tax regime

· greater scope for development

· more complicated procedures and bigger costs

Are you still not sure? Consult Partena Professional, their experts can discuss it with you. Book an appointment with Partena Professional

Main steps to become self-employed or to start a company

This is the overview of the main steps for each of the forms:

Becoming self-employed

3 main steps

1. Check if you need specific authorisations

2. Ask for your company number

3. Join a social insurance fund and a mutual health insurance

For these steps, you can consult Partena Professional

Starting a company

6 main steps

Before you start, define a name for your company and decide whether or not you're hiring staff

1. Choose the status of your company

2. Draw up a financial plan

With the Premium plan of Partena Professional, the financial plan is included.

3. Open a dedicated bank account

Our partner KBC Brussels has great offers for expats KBC Expats in Brussels , or choose any other bank.

4. Register the deed of incorporation

You can do it via a business counter – e.g. Partena Professional or the notary

5. Register your company with the Federal Service/ The Crossroads Enterprises

6. Join a social insurance fund and a mutual health insurance

For these steps, you can consult Partena Professional

Additional step – join the Brussels Business Community via Brussels Chamber of Commerce and Industry Affiliation

Each of the types involves certain costs. You can check them in the following chapter “Approximate costs for setting up a business in Belgium”

Three main steps to become self-employed in Belgium

To register as a self-employed person, you must meet certain legal requirements:

- be of legal age (18+)

- enjoy your civil rights (you have never been convicted of serious misconduct or crimes)

- be legally capable (you are not led by a provisional administrator, and you haven’t been declared legally or judicially incompetent)

- be a citizen of the European Union or of Iceland, Liechtenstein, Norway, and Switzerland OR have a professional card

Professional Card

If you are not a national of a European Union Member State and you want to become self-employed in Belgium, you need a professional card for foreign nationals.

In addition to EU nationals, citizens of Iceland, Liechtenstein, Norway, and Switzerland are also exempt from the professional card requirement. You may also be exempt for other reasons, for example because you are married to an EU national or starting your work in Belgium as an assisting spouse.

How to apply for a professional card?

You should apply for a professional card at the Belgian diplomatic or consular post in the country where you have your permanent residence. If you are already a legal resident in Belgium, you can submit your application for a professional card via a business counter. For example, Partena Professional business counter located at Beci, 500 Ave. Louise Brussels 1050 can help you with that.

NB: Steps 2 and 3 are done at the same time via the business counter or online

You can register as a self-employed person with or without an establishment unit.

If you are residing in Belgium, then most likely you will wish to register with an establishment unit. If you plan to work only part-time or arrive for a few months, then you register as self-employed without an establishment unit. (most of the time it is done by nationals of the nearby countries, who do not want to change their residency in their home countries)

Self-employed with a business unit

(An establishment unit is any place that can be geographically identified by an address, where at least one of the entity's activities is carried out or from which the activity is carried out (e.g. workshop, retail unit, warehouse, sales outlet, office, head office, registered office, agency, branch and subsidiary –more information here).

If you start a self-employed activity in Belgium as a physical person with a business unit:

- you will open a business bank account;

- you will complete the compulsory formalities via the Partena Professional Business portal: registration with the Crossroads Bank of Enterprises; examination of the conditions relating to business management and professional qualifications; social security affiliation; licence application; and VAT registration.

Self-employed without a business unit

If you want to set your self-employed business without a business unit, you need to:

- Open a business bank account

- Complete the compulsory formalities via a business counter, (e.g. Partena Professional):

- if you need authorisation via the counter, you must demonstrate your knowledge of business management in the Walloon Region or if you are involved in itinerant trade (in the three Regions):

- registration with the Belgian Crossroads Bank for Enterprises,

- examination of the other conditions (business management and professional qualifications),

- any permits required

- social security affiliation

Social insurance

As soon as you start your activity, you must join a social security fund to pay your contributions.

Each quarter, you must pay 20.5% of your taxable income.

The minimum contribution for people starting out as self-employed as their main business is approximately €900 for a quarter. Your social security contributions will be adjusted when the social insurance fund receives the information on your actual turnover.

For detailed information on social insurance funds, rights, and contributions, please checkSocial contributions

You can join a social insurance fund at a business counter when you complete the formalities in Step 2.

Mutual health insurance

Unlike certain countries, registration with a Belgian health insurance fund is not automatic, it is up to you to request it. Once you have registered you can be fully or partly reimbursed if you have an accident, are admitted to hospital or visit your doctor or dentist.

Business & Expats Health insurance can assist you in registering with a Belgian health insurance fund.

Signing up has never been easier!

Complete the online form and one of our advisors will contact you as soon as possible to assist you in your efforts.

To access the form, go to business.healthinsurance.be

Six main steps to start a company in Belgium

Please not: first define a name for your company, where you would want its legal address to be, and decide if you are hiring staff

There are various types of companies in Belgium: SRL, SA, SC, SNC, SCS, etc. All have their own specific features (some, for example, require a minimum capital to be paid up, which is not the case for others). You need to identify the most advantageous status for your project by questioning your characteristics:

- target sector

- start-up capital

- business objectives

- etc.

Types of for-profit companies

The minimum number of partners, the start-up capital (required or not), the intervention of a notary (mandatory or not) and the level of personal liability determine the company form you’ll choose.

Choose your legal status and business type

Types of non-profit organisations

When the goal of the company is not personal enrichment but rather a selfless goal of improving society, it is possible to carry out its activity in the form of a non-profit organisation. The types of non-profits in Belgium are:

- Non-profit association by membership VZW/ASBL: ASBL is the legal term for a basic non-profit organisation, the organisations are entered in a register and allocated numeric identifiers.

A minimum of two people is required to found an ASBL. These two people agree on the statutes, which are published in the Belgian Official Gazette. It is not possible to be an employee as a director of an ASBL, but this is allowed for specific tasks other than the day-to-day management of the association (e.g., giving courses or running the art gallery).

- International non-profit association IVZW/AISBL: an organisation located in Belgium, acts internationally but under the Belgian law

- Private non-membership organization for the common good - Stichting van openbaar nut (Dutch, abbreviated SON) or Fondation d'utilité publique (French, abbreviated FUP).

An informal organization, often started for a short-term project, or managed alongside another non-profit that does not have any status in law, and thus cannot purchase property, etc.

Registration of Foreign Entities

Steps to take at the Business Counter

There are many options for a foreign entity wishing to carry out activities in Belgium and to settle in the country: it can set up a branch, a subsidiary, or a business unit.

Branch

From a legal perspective, a branch within the meaning of the Companies Code is not a separate entity of the company. The branch has no legal personality; the branch and the foreign entity are one single entity.

An entity which sets up a branch in Belgium, if it does not yet have one, receives an enterprise number. This number is communicated by the registry of the competent company court, at the time of the filing prior to the opening of the branch.

It must then apply to the business counter of its choice to be registered as a company subject to registration.

A legal representative of the foreign company must be appointed to its management. The deed of appointment must define the extent to which they are authorised to bind the foreign company in the context of the branch's activities. When a branch office enters a contract, it is in fact the parent company that is committed.

Subsidiary

Legally, the subsidiary is a separate entity from the foreign entity. It has a legal personality (unlike the branch). The legal form chosen is then a type of company under Belgian law.

The subsidiary established in Belgium obtains an enterprise number when it is registered with the CBE (Crossroads Bank of Enterprises, read more about it in Step 5). It must then apply to the business counter of its choice to be registered as a company subject to registration.

Establishment (or Business) unit

Some foreign entities may conduct their activities in Belgium without having a branch or subsidiary. In such cases, these entities conduct their activities from a specific location. This place is known as an establishment unit, which could be a workshop, factory, shop, sales outlet, office, etc. Similar to a Belgian company, the Establishment Unit is a place of business, with a specific address where the entity carries out at least one activity.

The entity which has an establishment unit in Belgium obtains an enterprise number via the business counter when registering its establishment unit with the CBE.

Working without settling in Belgium

If a foreign company carries out activities in Belgium without being established there (e.g., consultancy activities), it should submit an application for authorisation through the Business Counter. If the chosen counter is in Wallonia or Brussels, a professional card and access to management are necessary

Source: Setting up a business as a foreigner (non-European resident)

When setting up a new company, the financial plan is a forecast table that forms part of the business plan.

It lists:

- your financial resources

- your investment requirements

Its purpose is to check the balance between these resources and these needs and, in this way, to ensure the long-term viability of your project.

The financial plan is an essential part of your business plan. Drawn up by your chartered accountant (an accountant that has a professional accreditation) based on your business plan, it will help you avoid unpleasant surprises and will prove decisive in convincing potential partners or investors. Without a realistic plan based on concrete figures, your project will often remain at the idea stage.

For some types of company, a financial plan is compulsory and must be filed with a notary. Does your company go bankrupt within 3 years of being set up? Then you and your partners can be held liable if the financial plan shows that you did not provide sufficient start-up capital. Find out more here: notaire.be

Partena Professional can help to draw a financial plan and a business plan.

The role of an accountant

If you're setting up a company, you have no choice: an accountant is compulsory.

Before making an appointment with an accountant, start by drawing up your business plan, setting out on paper the objectives you want to achieve. Think about what you want to earn and how you want to get there. By clarifying your ideas about these figures, you'll be better prepared for the first meeting with your accountant. This first step will help you determine whether your idea is really feasible.

Your accountant will really be your right hand, your adviser, and the person you trust. You'll be forming a team together.

Your chartered accountant will also cost you money, but this cost will soon pay for itself in the same way as an investment. Because chartered accountants know all the tricks of the trade, saving you a great deal of time and money, as well as alleviating any worries you may have. Last but not least, your chartered accountant also plays an advisory role in your business start-up: financial plan, financial viability of your projects, start-up costs, best financing options for your potential investments... In short, the chartered accountant is a key person in the success of your business!

KBC Brussels: ‘A unique approach for a unique city’

Opening a bank account is often one of the first steps an expat needs to take. The bank therefore presents itself as a gateway to life abroad, serving as both the first point of contact and the key to a successful move.

This of course means that for expats, the bank's role goes far beyond simply providing financial services, especially in the complex institutional and multicultural landscape that is the city of Brussels!

KBC Brussels has developed what they like to call ‘a unique approach for a unique city’. They've set out to be the preferred financial partner for everyone living and working in Brussels, accounting for everything that makes the city what it is so that the customers have the support they need to pursue their personal and professional goals.

Each expat has their own particular requirements and needs, which is why KBC Brussels provides an ultra-personalised service to suit their specific situation. This no doubt explains why 20% of KBC Brussels' customers are expats.

Making the formalities easy

If you’re planning a move to Brussels, KBC Brussels lets you take care of all the formalities remotely, and that includes opening an account from abroad.

As soon as you arrive, the experts at our dedicated Expat branches located all over Brussels (Mérode, Marnix, Schuman, Stockel, Louise and La Cambre) are on hand to help you get settled in easily, welcoming you in your own language and giving you all the information you need, not mention any payment cards you’ve ordered!

KBC Brussels' personalised approach covers not just financial services (accounts, cards, apps, security deposits, saving, investments, borrowing, etc.) but also issues relating to housing, insurance products specific to Brussels, education, transport, and more.

You can also count on banking apps to make the city easier (KBC Brussels' apps have been voted the best in Belgium) and on the bank's business expertise to help you start your own business, for example.

KBC Brussels has earned a reputation as the bank for Brussels locals who like to get things done, but it's also the go-to bank for expats!

Incorporation of the company involves three stages:

- registration

- filing

- publication

The incorporation is filed electronically or at the Registry of the Company court

This task is performed by a notary or specialised lawyer; and is part of the Partena Professional service.

They can draw up a foundation deed, in which you appoint at least one director. The notary then goes to the Commercial Court where the report of the meeting and an extract from the articles of association are filed with the court registry. Your company ‘exists’ from this point on. You will receive a company number through the Crossroads Bank for Enterprises (CBE/KBO) and you can start. The procedure will finally be complete when the foundation text is published in the Belgian Official Gazette.

The notary informs the client of the enterprise number. After that the client has to contact the business counter for Step 5.

The entity should be registered with The Crossroads Bank for Enterprises (CBE) (FR: Banque-Carrefour des Entreprises (BCE) ; NL: Kruispuntbank van Ondernemingen (KBO)). This is a database belonging to the Federal Public Service Economy. The BCE assigns each company a unique identification number, which will also serve as the basis for your company's VAT number.

The entity must use its enterprise number in all contacts with the administrative or judicial authorities. For example, the enterprise number is also used for identification purposes with the VAT administration and the NSSO (National Social Security Office). Any company subject to registration must indicate its enterprise number on all deeds, invoices, announcements, notices, letters, orders, and other documents.

The registration with CBE is done by a business counter.

Currently, eight organisations are accredited as business counters (also called Enterprise Counter) (FR Guichet d’Entreprise NL Ondernemingsloket) in Belgium. Beci has partnered with Partena Professional, and their business counter is located straight in the Beci offices at Ave Louise 500 Brussels.

What does a business counter do?

The business counter performs a variety of tasks:

- It checks whether you meet the legal requirements to be allowed to carry out your intended activity ;

- It arranges your (mandatory) registration with the Crossroads Bank for Enterprises;

- It can take care of certain administrative formalities on your behalf, such as:

- completing your identification with the VAT administration;

- requesting various authorisations (FASFC, SABAM, etc.).

The business counters could also offer other services, such as:

- affiliation to a social insurance fund for the self-employed (each enterprise counter has an affiliated social insurance fund);

- advice on setting up your project;

- the drafting of dossiers for subsidy applications;

- training;

- support during the first months of activity, etc (source)

Additional step: join the Brussels Business Community via Brussels Chamber of Commerce and Industry.

Social insurance

As soon as you start your activity, you must join a social security fund to pay your contributions.

Each quarter, you must pay 20.5% of your taxable income.

The minimum contribution for people starting out as self-employed as their main business is approximately €900 for a quarter. Your social security contributions will be adjusted when the social insurance fund receives the information on your actual turnover.

For detailed information on social insurance funds, rights, and contributions, please checkSocial contributions

You can join a social insurance fund at a business counter when you complete the formalities in Step 2.

Mutual health insurance

Unlike certain countries, registration with a Belgian health insurance fund is not automatic, it is up to you to request it. Once you have registered you can be fully or partly reimbursed if you have an accident, are admitted to hospital or visit your doctor or dentist.

Business & Expats Health insurance can assist you in registering with a Belgian health insurance fund.

Signing up has never been easier!

Complete the online form and one of our advisors will contact you as soon as possible to assist you in your efforts.

To access the form, go to business.healthinsurance.be

Approximate costs for setting up a business in Belgium

Setting up a company inevitably involves expenditure. To cover all these costs, you should plan on spending around €2,000, although this amount may vary depending on the status of the company and your needs. The main costs to be anticipated are those relating to points one to five.

Please note: It is impossible to define the costs of setting up a company in Belgium without mentioning the question of minimum capital. These amounts vary according to the type of company: 61,500 euros for a SA (public limited company) and 0 euros for a SRL (private limited company).

The financial plan, the objectives of which we have listed above, is compulsory for certain types of company (SA, SC, etc.). These costs are for the accountant who will draw up the plan for you. Even if you do it yourself, it should still be validated by an accountant. See the role of the accountant above

Approximate cost: around €500 excluding VAT

You do it via a Business Counter (e.g. Partena Professional)

As a public official responsible for drawing up or receiving deeds and contracts that people need to be authenticated, the notary incurs costs.

Approximate cost: around €1,400 excluding VAT

You can do this via a Business Counter (e.g. Partena Professional)

The Belgian Official Gazette or Moniteur belge (MB) produces and distributes a wide range of official and public publications. A company must have an extract of the notarial deed published in the appendices to this official journal.

Approximate cost: around €200 excluding VAT

You can do this via a Business Counter (e.g. Partena Professional)

All companies must be issued with a unique company number. This number, also known as the RPM (Registre des Personnes Morales), consists of 10 digits.

Approximate cost: around €100

You can do this via a Business Counter (e.g. Partena Professional)

In Belgium, a company must register for VAT when:

· it supplies goods or provides services described in the VAT Code (CTVA)

· its activity is not exempt under Article 44 of the VAT Code.

Approximate cost: €70 excluding VAT

If you want to hire personnel in Belgium

As a foreign company, you are sometimes faced with challenges regarding the employment of personnel in Belgium. Belgian socio-legal and labour law matters have their own specific characteristics when it comes to the employment of staff.

As an employer in Belgium, you must fulfill certain obligations. And Partena Professional can help you in these matters, too!

Your main obligations are to:

- conclude employment contracts;

- provide pay slips to your employees;

- draw up employment regulations listing the rights and obligations of employer and employee. This is a practical translation of the provisions contained in the employment contracts. Every employer must draw up employment regulations when he employs his first employee;

- have a working accident insurance. You can find any available insurance, and Partena works with P&V insurance for that. If the headquarters of your company are abroad, the insurer will also require you to have a “social representative or social agent” (FR “mandataire social” NL “sociaal mandataris”) in Belgium – see more about that below;

- be affiliated to an external service for prevention and protection at work. In case of Partena, you will be affiliated to Mensura and they will provide the necessary documents;

It has an HR service – Partena Business Solutions that is aimed at:

- Foreign companies posting staff in Belgium without having a legal entity in Belgium

- Foreign companies employing staff in Belgium without having a legal entity in Belgium

- If you establish a company in Belgium and want to outsource the HR services

Discover Partena Business Solutions

In all cases, you will need to have a Belgian company number for your entity. To get this number, Partena will register your company with the Belgian Social Security Office (ONSS in French, RSZ in Dutch) and the Crossroads Bank of Enterprises (in French: Banque Carrefour des Entreprises, in Dutch: Kruispuntbank voor ondernemingen).

In the first case, i.e. if you want to have staff from your country working in Belgium, according to a Belgian employment law, you must appoint a liaison/contact person (FR Mandataire Social) who can act on your behalf with the Belgian official bodies. In the second case, it is strongly recommended to appoint a social agent to act as a contact person for the official bodies. The agent also keeps the record of your social documents and acts a contact person for the Belgian inspection services.

Partena Business Solutions can take up this role for your company. They have a team of officers, so the staff turnover won’t impact you, and you will benefit from a reliable support.

If a foreign company posts staff in Belgium, without establishing an entity

Partena Business Solutions PLC will:

- Act as a point of contact for the official institutions in Belgium

- Communicate with the inspection services of the Belgian Federal Public Service Employment, Labour and Social Dialogue

- Keep the database of social documents up-to-date:

o A copy of the employment contract;

o The information about the foreign currency for the payments, the benefits in case or in kind, conditions of the repatriation;

o Time sheets

o Proof of payments

o Regulatory documents (if any)

If a foreign company employs staff in Belgium, without establishing an entity

Partena Business Solutions PLC will:

- Act as a point of contact for the official institutions in Belgium

- Communicate with the inspection services of the Belgian Federal Public Service Employment, Labour and Social Dialogue

- Keep the following documents:

o employment regulations

o staff register

o individual account (+ annexes)

o pay slips

o regular employment contracts

o working time arrangements (start, end and duration of daily working time

o notice announcing the part-time work schedule

o agreements for temporary contracts

o student employment contracts

o Dimona overview (Dimona stands for 'Déclaration IMmédiate – ONmiddellijke Aangifte'. It is an electronic notice that employers in Belgium are required to submit to the National Social Security Office (NSSO). It serves as a declaration for both hiring and leaving employees, in both the private and public sectors)

o Dimona message

o the monthly time sheet in case of flexible schedules

o work performed each month

o proof of payment of wages

o posting certificate

o tax slip

Costs: The standard annual fee is € 970,00/year; hourly rate for additional tasks - € 127,00/hour (as of 2024)

Registration is free, and approximate cost for social security contributions (paid quarterly) is approximately 850 euros (minimum)

You can do this via a Business Counter (e.g. Partena Professional)

What are social security contributions?

Social security contributions entitle you and your family to basic social protection, including in particular:

- Your entitlement to family allowances

- Birth and maternity grants

- Sickness and disability insurance

- Your statutory pension

- Bankruptcy insurance

As a self-employed person, you must join a social insurance fund, which collects these contributions on behalf of the State, and manage your social file yourself in order to meet all your legal obligations.

If you do not plan to rent an office space and don’t want to have your company to be registered at your home address, you can use the domiciliation service of Beci.

- Domiciliation refers to a company's administrative, tax and/or operating address. Designating an address for your company's registered office and/or business premises is essential. It enables your company to be identified and registered with the Banque-Carrefour des Entreprises de Belgique (Crossroads Bank of Enterprises in Belgium).

- Registering your company means assigning an official address to your organisation, which will appear on all legal documents (letters, invoices, etc.).

- Domiciliation at Beci means that you company’s legal address will be at Ave Louise 500 Brussels – a strategic location on a prestigious avenue in the centre of the Belgian capital.

The cost for domiciliation at Beci starts at €63/month excluding VAT.

It includes a physical mailbox at avenue Louise 500 in 1050 Brussels, accessible during our opening hours, and:

o Legal formalities for your company at the Partena Professional Business counter on the ground floor.

o Digitalisation of your mail. Your mail is sorted and opened mechanically. It is then scanned daily and sent to you in PDF format.

o Receiving telephone calls and taking messages.

o Redirection of your mail to a specific address.

o Book our workspaces, meeting rooms, terraces, and car parks online in just a few clicks.

o Catering for your meetings.

Partena Professional can be your legal representative in Belgium. (Read more in Chapter: If you want to hire personnel in Belgium)

Costs: The standard annual fee is € 970,00/year excl VAT; it includes

· Collecting of documents

· Scanning of documents

· Structuring of documents

· Contacting the competent authorities to announce our mandate

· Updating of the document records

· History (archiving)

Hourly rate for additional tasks - € 127,00/hour excl VAT